income tax rate indonesia

Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian. 4 Indonesian Pocket Tax Book 2022 PwC Indonesia Corporate Income Tax Taxation on certain offshore income Indonesian tax residents are generally taxed on a worldwide income basis.

Indonesia Income Tax Rates For 2022 Activpayroll

Over IDR 500 million.

. Generally a flat rate of 22 applies becoming 20 in 2022. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Follow these simple steps to calculate your salary after tax in Indonesia using the Indonesia Salary Calculator 2022 which is updated with the 202223 tax tables.

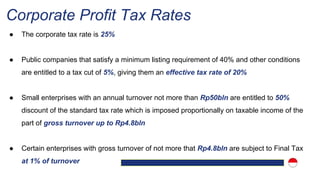

Public companies that satisfy a minimum listing requirement of 40 in Indonesia Stock. CORPORATE INCOME TAX. While for non-resident taxpayers are subject to final witholding tax of 20 on gross income but.

Enter Your Salary and the. Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax rate 22 standard ratevarious Residence. Generally the VAT rate is 10 percent in Indonesia.

The regulation changes show further flexibility in tax liability. Corporate taxpayers with an annual turnover of not more than 50 billion rupiah IDR are entitled to a 50 tax discount of. Small company discount.

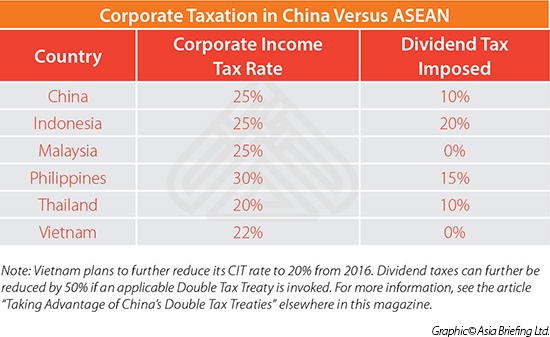

Normal rate of taxation in Indonesia corporate income is 25. Over IDR 250 million- IDR 500 million. Refer to the following table for the tax rates in Indonesia.

However the exact rate may be increased or decreased to 15 percent or 5 percent according to. Corporate Income Tax Rate in Indonesia. Corporate Tax Rate in Indonesia averaged 2776 percent from 1997 until 2021 reaching an all time high of 39 percent in 2002.

Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed. The Corporate Tax Rate in Indonesia stands at 22 percent. A company will be considered taxable in Indonesia if it has a presence and conducts business in that country.

Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent. Interest income on time or saving deposits and on Bank of Indonesia Certificates SBIs received by a resident company or a PE is taxed at a final tax rate of 20 whilst interest. This means that you will start to use general tax rates.

Tax rates range from 5 to 35. This means that the higher the income generated the higher the tax rates are. Indonesia company tax rate is 25.

If your annual gross income is not above IDR 48 billion. The Personal Income Tax Rate in Indonesia stands at 30 percent. Salary range per annum.

How Do Taxes And Transfers Impact Poverty And Inequality In Developing Countries

International Comparisons Of Corporate Income Tax Rates Congressional Budget Office

Indonesia Provides Reduced Tax Rate On Bond Income Of Collective Investments Orbitax Tax News Alerts

Taxes In Indonesia Guide Expat Com

Indonesia Salary Calculator 2022 23

Personal Income Tax In Indonesia For Expatriate Workers Explained

Layer Added Income Above Idr 5 Billion Is A Subject To 35 Income Tax Rate

Indonesia Personal Income Tax Rate 2022 Take Profit Org

Income Tax Rates By Country Global Salaries After Taxes Caprelo

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

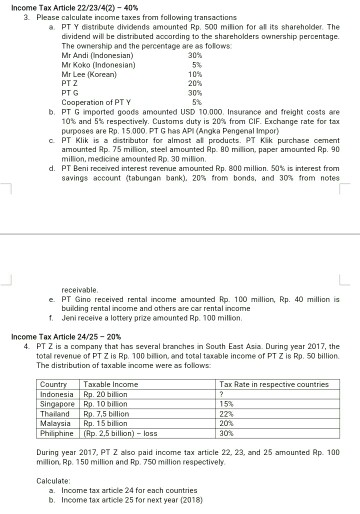

Income Tax Article 22 23 4 2 40 3 Please Calculate Chegg Com

Taxation System In Indonesia Your Guide To Income Taxation

Why Indonesian Are Less Innovative The Role Of Tax Institution In Innovation Economics Accounting And Taxation Ecountax Com

Asiapedia Indonesia Page 15 Dezan Shira Associates

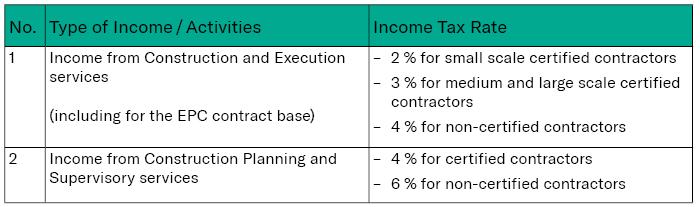

International Turnkey Contracting In Asean Epc Projects In Indonesia Rodl Partner

Taxation System In Indonesia Your Guide To Income Taxation

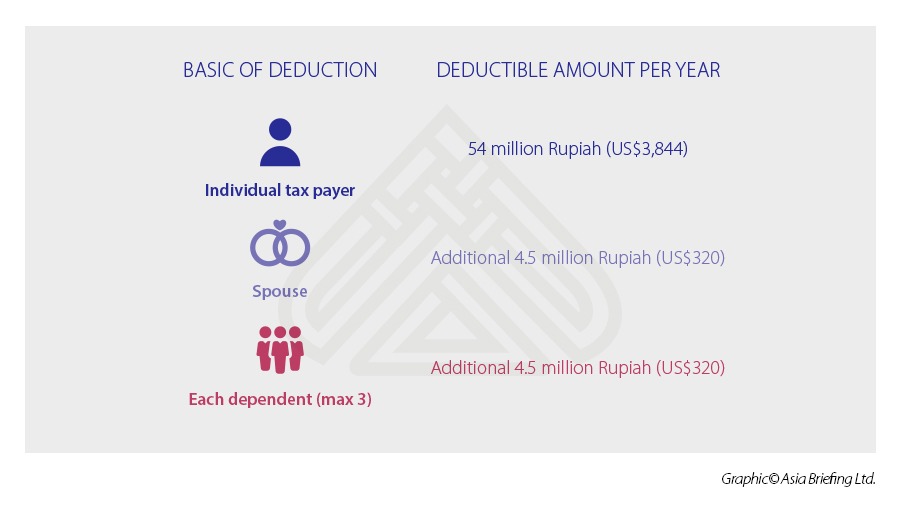

Indonesia Individual Taxes On Personal Income